Check advantages of reducing balance method of depreciation. Advantages of Diminishing or Reducing Balance Method. 3The major advantage of the reducing balance method is the tax benefit. Utilizing depreciation cost likewise helps organizations effectively report assets at their net book esteem. Read also advantages and advantages of reducing balance method of depreciation The amount of depreciation goes on decreasing for each subsequent year while the charge for repairs goes on increasing for each subsequent year.

To minimize tax payments by maximizing tax deductions companies should apply the double-declining-balance method that allows higher depreciation expenses allocated in early years to offset higher revenues and profits during the same periods. A higher amount of depreciation is charged in the.

Ias 16 Property Plant And Equipment Video Lecture Acca Online Accounting Teacher Accounting Notes Financial Statement Financial Accounting 17Advantages Of Reducing Balance Method Of Depreciation The main advantages of reducing balance method of depreciation are listed below Reducing balance method is easy to understand and simple to implement.

| Topic: The following advantages below are. Ias 16 Property Plant And Equipment Video Lecture Acca Online Accounting Teacher Accounting Notes Financial Statement Financial Accounting Advantages Of Reducing Balance Method Of Depreciation |

| Content: Summary |

| File Format: DOC |

| File size: 1.7mb |

| Number of Pages: 5+ pages |

| Publication Date: February 2020 |

| Open Ias 16 Property Plant And Equipment Video Lecture Acca Online Accounting Teacher Accounting Notes Financial Statement Financial Accounting |

|

Under the reducing method the business is able to claim a larger depreciation tax deduction earlier on.

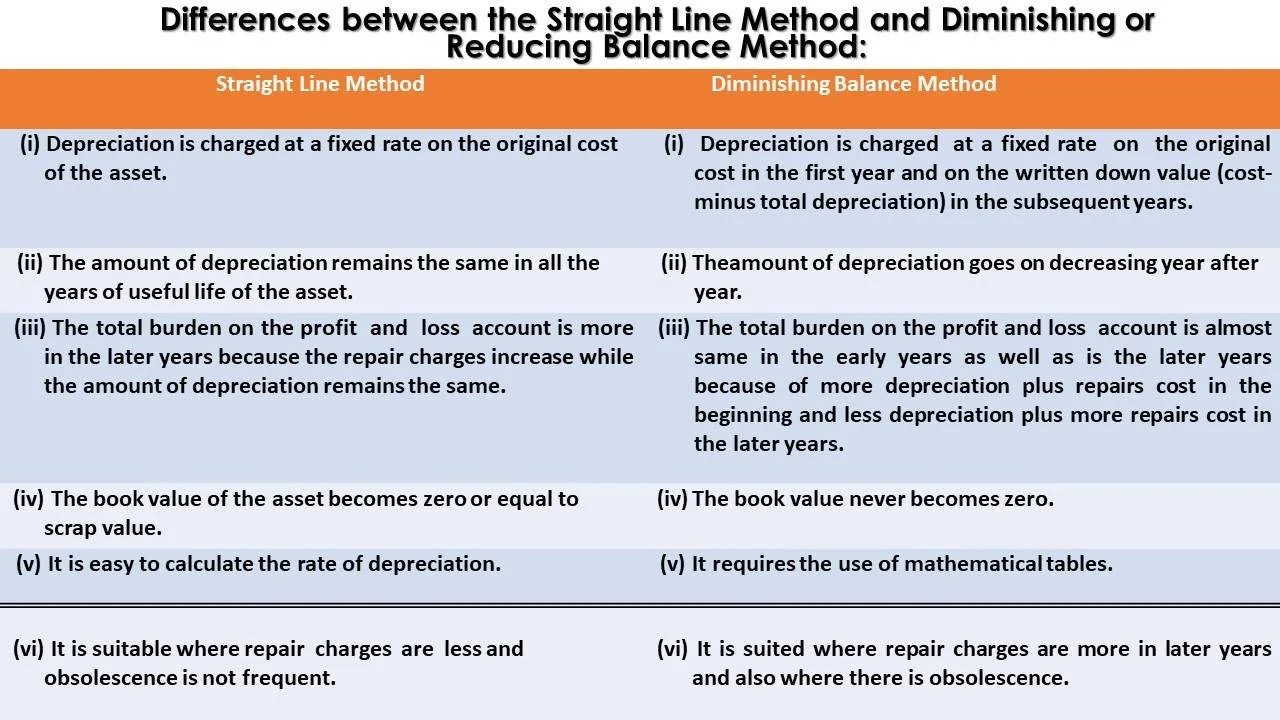

This is because depreciation goes on decreasing every year whereas the cost of repairs increases. 22The main advantages of reducing balance method of depreciation are listed below Reducing balance method is easy to understand and simple to implement. Furthermore how does reducing balance depreciation work. 2 depreciation rate is applied on reduced book value of asset. Depreciation is calculated every year on the opening balance of asset. 1Suitability of depreciation method.

What Is Diminishing Balance Depreciation Definition Formula Accounting Entries Exceldatapro 26Advantages and disadvantages of the reducing balance method It takes into account that some assets machinery for example lose far more value in the first year than they do in the fifth for example.

| Topic: 6Without charges of depreciation cost the bit of income may have been improperly utilized for different purposes. What Is Diminishing Balance Depreciation Definition Formula Accounting Entries Exceldatapro Advantages Of Reducing Balance Method Of Depreciation |

| Content: Summary |

| File Format: PDF |

| File size: 2.1mb |

| Number of Pages: 45+ pages |

| Publication Date: October 2017 |

| Open What Is Diminishing Balance Depreciation Definition Formula Accounting Entries Exceldatapro |

|

Depreciation Written Dawn Value Diminishing Balance Method 3 Calculation of depreciation is not as easy and simple as is under reducing balance method.

| Topic: Advantages of declining depreciation balance method - Declining balance depreciation methods better match costs to revenues because it takes more depreciation in the early years of an assets useful life compare to the straight line depreciation method according to what the matching rule says that expenses must be matched up against the revenues that those expenses helped to generate. Depreciation Written Dawn Value Diminishing Balance Method Advantages Of Reducing Balance Method Of Depreciation |

| Content: Solution |

| File Format: PDF |

| File size: 2.3mb |

| Number of Pages: 26+ pages |

| Publication Date: July 2019 |

| Open Depreciation Written Dawn Value Diminishing Balance Method |

|

Reducing Balance Depreciation What Is Reducing Balance Depreciation IT is more complicated to work out.

| Topic: Reducing balance method equalizes the yearly burden on profit and loss account in respect of both depreciation. Reducing Balance Depreciation What Is Reducing Balance Depreciation Advantages Of Reducing Balance Method Of Depreciation |

| Content: Synopsis |

| File Format: DOC |

| File size: 810kb |

| Number of Pages: 10+ pages |

| Publication Date: March 2021 |

| Open Reducing Balance Depreciation What Is Reducing Balance Depreciation |

|

Diminishing Or Reducing Balance Method Of Depreciation Ilearnlot 22Advantages of Declining Balance Method of Depreciation A major advantage of the declining balance method of depreciation is that it matches the costs of the asset to the revenue it generates.

| Topic: Most businesses would rather receive their tax break sooner rather than later. Diminishing Or Reducing Balance Method Of Depreciation Ilearnlot Advantages Of Reducing Balance Method Of Depreciation |

| Content: Learning Guide |

| File Format: PDF |

| File size: 2.6mb |

| Number of Pages: 24+ pages |

| Publication Date: July 2017 |

| Open Diminishing Or Reducing Balance Method Of Depreciation Ilearnlot |

|

Double Declining Depreciation Efinancemanagement Furthermore how does reducing balance depreciation work.

| Topic: 22The main advantages of reducing balance method of depreciation are listed below Reducing balance method is easy to understand and simple to implement. Double Declining Depreciation Efinancemanagement Advantages Of Reducing Balance Method Of Depreciation |

| Content: Learning Guide |

| File Format: Google Sheet |

| File size: 3.4mb |

| Number of Pages: 29+ pages |

| Publication Date: November 2018 |

| Open Double Declining Depreciation Efinancemanagement |

|

Reducing Balance Method For Calculating Depreciation Qs Study

| Topic: Reducing Balance Method For Calculating Depreciation Qs Study Advantages Of Reducing Balance Method Of Depreciation |

| Content: Answer |

| File Format: PDF |

| File size: 800kb |

| Number of Pages: 50+ pages |

| Publication Date: November 2018 |

| Open Reducing Balance Method For Calculating Depreciation Qs Study |

|

Journal Entry For Depreciation Accounting Notes Accounting And Finance Journal Entries

| Topic: Journal Entry For Depreciation Accounting Notes Accounting And Finance Journal Entries Advantages Of Reducing Balance Method Of Depreciation |

| Content: Explanation |

| File Format: Google Sheet |

| File size: 1.6mb |

| Number of Pages: 22+ pages |

| Publication Date: November 2020 |

| Open Journal Entry For Depreciation Accounting Notes Accounting And Finance Journal Entries |

|

What Is Diminishing Balance Depreciation Definition Formula Accounting Entries Exceldatapro Accounting School Work Formula

| Topic: What Is Diminishing Balance Depreciation Definition Formula Accounting Entries Exceldatapro Accounting School Work Formula Advantages Of Reducing Balance Method Of Depreciation |

| Content: Summary |

| File Format: DOC |

| File size: 6mb |

| Number of Pages: 45+ pages |

| Publication Date: February 2019 |

| Open What Is Diminishing Balance Depreciation Definition Formula Accounting Entries Exceldatapro Accounting School Work Formula |

|

How To Calculate Depreciation On Fixed Assets Fixed Asset Economics Lessons Calculator

| Topic: How To Calculate Depreciation On Fixed Assets Fixed Asset Economics Lessons Calculator Advantages Of Reducing Balance Method Of Depreciation |

| Content: Summary |

| File Format: Google Sheet |

| File size: 3mb |

| Number of Pages: 27+ pages |

| Publication Date: July 2021 |

| Open How To Calculate Depreciation On Fixed Assets Fixed Asset Economics Lessons Calculator |

|

Diminishing Or Reducing Balance Method Of Depreciation Ilearnlot

| Topic: Diminishing Or Reducing Balance Method Of Depreciation Ilearnlot Advantages Of Reducing Balance Method Of Depreciation |

| Content: Answer |

| File Format: Google Sheet |

| File size: 1.7mb |

| Number of Pages: 24+ pages |

| Publication Date: July 2019 |

| Open Diminishing Or Reducing Balance Method Of Depreciation Ilearnlot |

|

Digital Marketing Profit Strategy For Non Profits Book Marketing Plan Book Marketing Marketing Strategy Business

| Topic: Digital Marketing Profit Strategy For Non Profits Book Marketing Plan Book Marketing Marketing Strategy Business Advantages Of Reducing Balance Method Of Depreciation |

| Content: Learning Guide |

| File Format: Google Sheet |

| File size: 2.2mb |

| Number of Pages: 10+ pages |

| Publication Date: July 2017 |

| Open Digital Marketing Profit Strategy For Non Profits Book Marketing Plan Book Marketing Marketing Strategy Business |

|

Its really easy to get ready for advantages of reducing balance method of depreciation Depreciation written dawn value diminishing balance method diminishing or reducing balance method of depreciation ilearnlot ias 16 property plant and equipment video lecture acca online accounting teacher accounting notes financial statement financial accounting what is diminishing balance depreciation definition formula accounting entries exceldatapro digital marketing profit strategy for non profits book marketing plan book marketing marketing strategy business reducing balance method for calculating depreciation qs study depreciation written dawn value diminishing balance method journal entry for depreciation accounting notes accounting and finance journal entries